How audax works

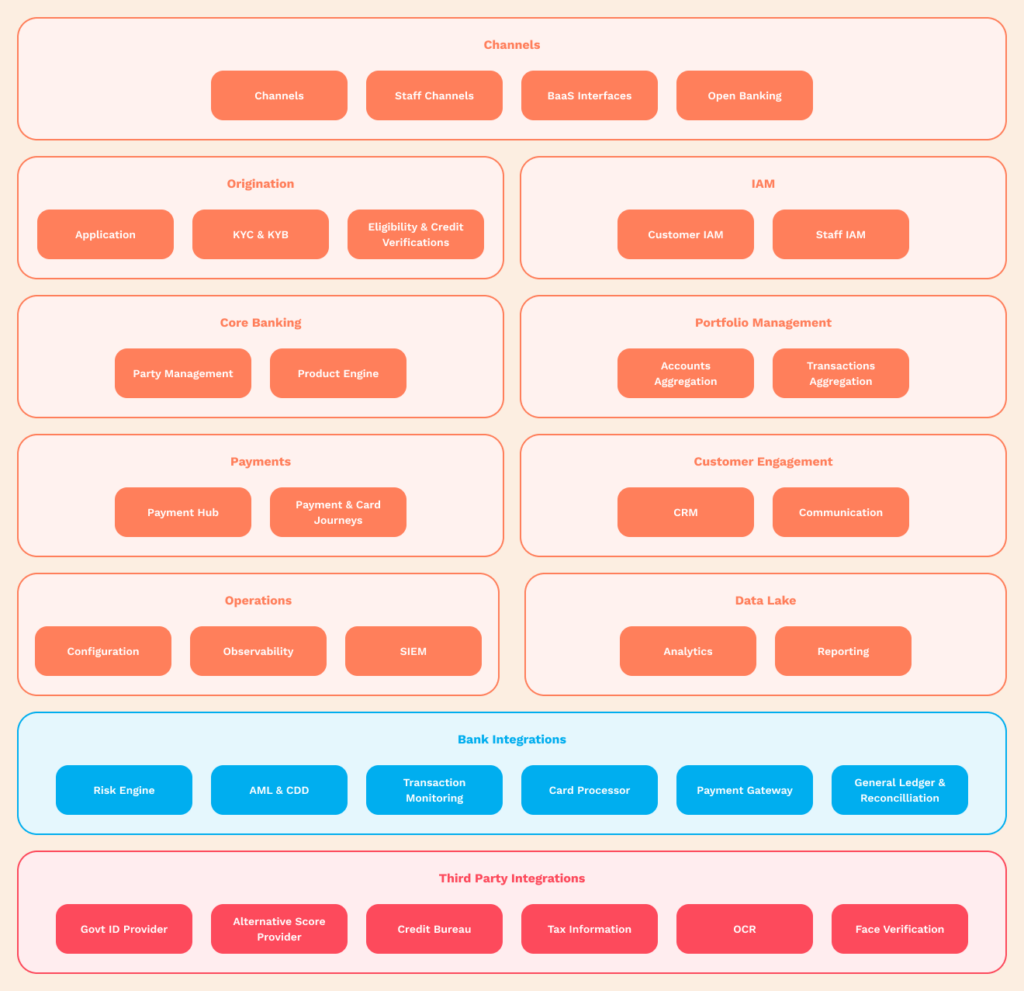

Our comprehensive suite of solutions on a single platform that can be deployed inside or outside of your bank’s environment.

Introducing our platform

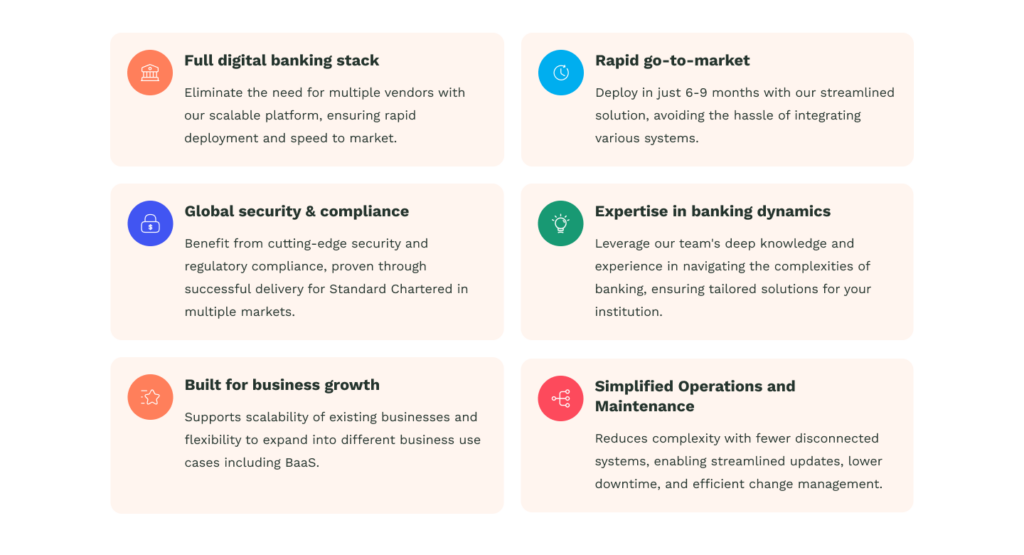

Tech Capabilities we can bank on

Additional services

Platform Delivery & Implementation

- Platform delivery

- Partner and vendor integration services

- Localisation

- Software as a Service

Consulting & Advisory Services

- Business model setup and country landscaping

- Market regulations

- Risk management and design

- Partner acquisition strategy

Value-Added Services

- Program management

- Data products and user insights

- User experience and design

Frequently asked questions

We are a digital banking capabilities provider that empowers banks and financial institutions to scale and modernise at speed. Here are some of the challenges we can help to address.

- Developing alternative business models

- Speed to market

- Building for the future

- Dynamic product changes

- Upgrading legacy infrastructure with a need for core migration

- Legacy tech ownership costs

- Adaptability to change

- Maintain relevance

Our cloud-native digital banking platform is rapid deployable, enabling banks and financial institutions to pursue scaled digital businesses, including digital banking, Banking-as-a-Service (BaaS), embedded finance and more.

Our platform can help banks to:

- Accelerate customer acquisition

- Lower risk/cost of new customers

- Access to larger volumes of data

- Create a contextualised value proposition

- Dramatically lower the cost of new services

- Enable digital eco-systems with financial services

Our approach and technology enable our customers to:

- Exponentially grow ecosystem with hundreds of partnerships securely using the bank’s core assets

- Serve bank customers like a full digital bank, keeping cost down; acquiring and serving all in-app

- Segregate partnership technology from BAU to mitigate scaling risks to core and better service delivery

- Test new use cases and business models quickly and with low risk

Our platform provides new technology rails, which will safely and securely enable the bank’s core assets to be utilised by new products, domains and partners. The assets include:

- Bank’s KYC/AML and credit decisioning rules

- Payment rails

- License/balance sheet

- Regulator reporting

- Bank’s infrastructure (on premise or cloud)

Embedded finance is an experience

Embedded finance refers to the integration of financial services and products into non-financial platforms and businesses, such as e-commerce, social media, or transportation services. Companies can now offer a more seamless and convenient experience for their customers, reducing their friction to obtain financial products such as loans, insurance, investments, and more.

Banking-as-a-Service is an enabler

Banking-as-a-Service (BaaS) is a model that enables banks & financial institutions to securely distribute financial products to facilitate embedded finance customer experiences via API’s. Our BaaS technology rails enable banks to provide services such as eKYC, accounts, loans, credit cards and payments to these 3rd parties, managing the accounts, balance sheet, regulatory reporting and risk, whilst the digital partner manages the consumer acquisition.

Embedded Finance is the ability to streamline customer experiences by eliminating extra steps to obtain financing via a B2C digital service.

BaaS is the ability for partners to securely distribute financial products to facilitate an embedded and white-labelled customer experience via API’s. BaaS allows banks to leverage on their retail banking license and balance sheet to achieve scale at a fraction of the price by creating new acquisition channels via multiple consumer platforms.

No. audax is a technology service provider that is installed and ran within the bank’s domain. The bank is the regulated entity per existing process. As such, audax will comply with all existing security and regulatory requirements of the bank as part of the checks to push to production.

The bank owns and has sole access to bank customers’ data that is processed and stored via the audax provided solution. The technology is installed within the bank’s domain/infrastructure and audax will have no access to this, unless explicitly instructed to do so, on behalf of the bank.