How audax works

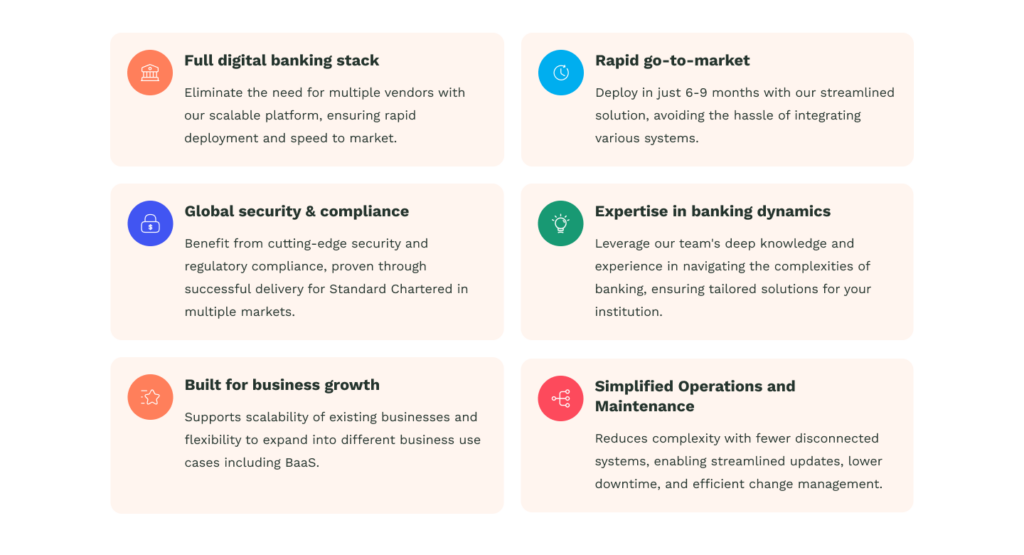

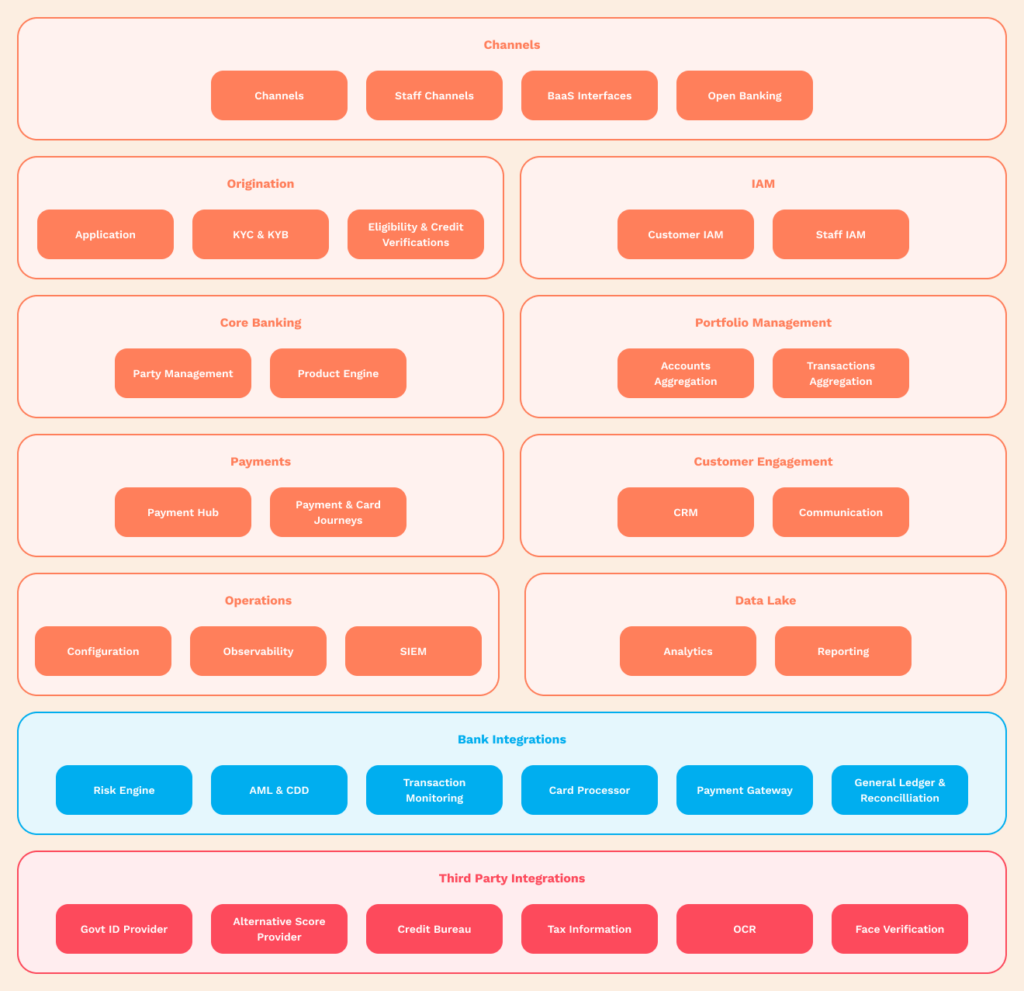

Our comprehensive suite of solutions on a single platform that can be deployed inside or outside of your bank’s environment.

Introducing our platform

Tech Capabilities you can bank on

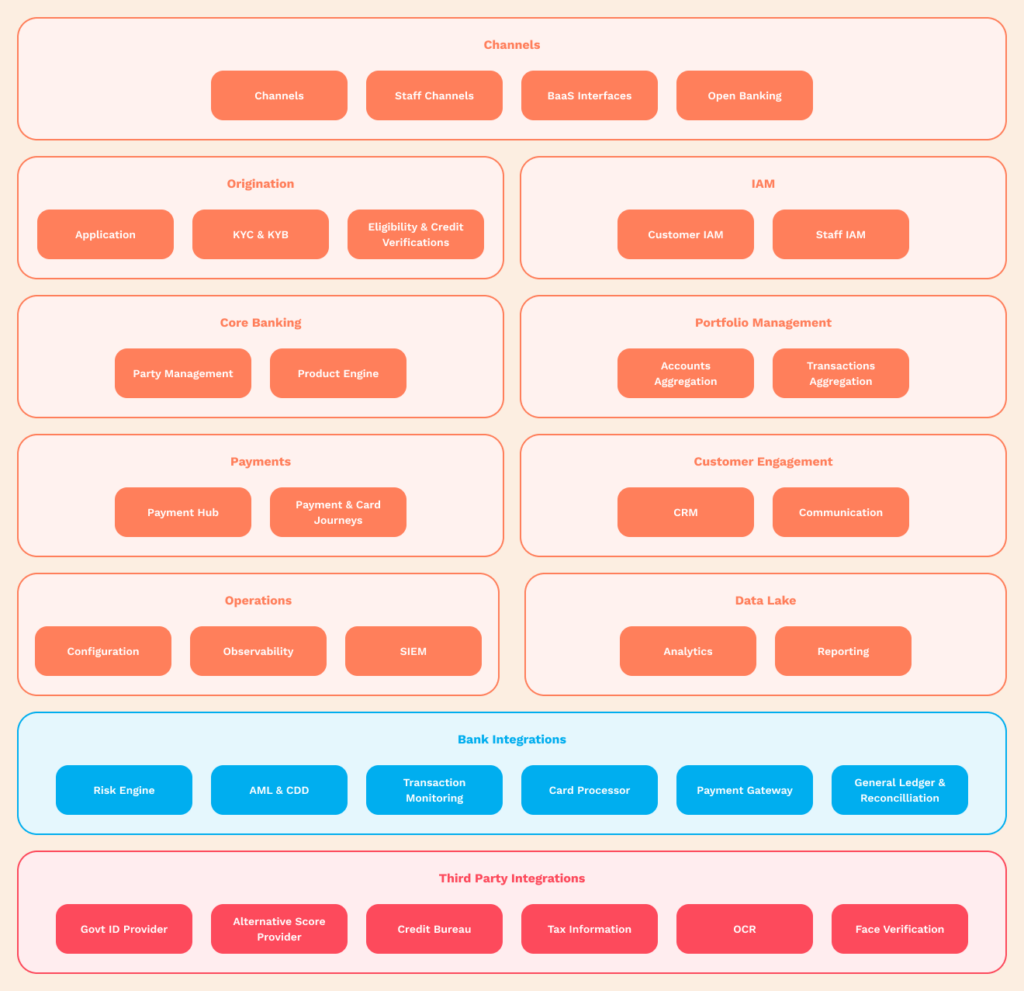

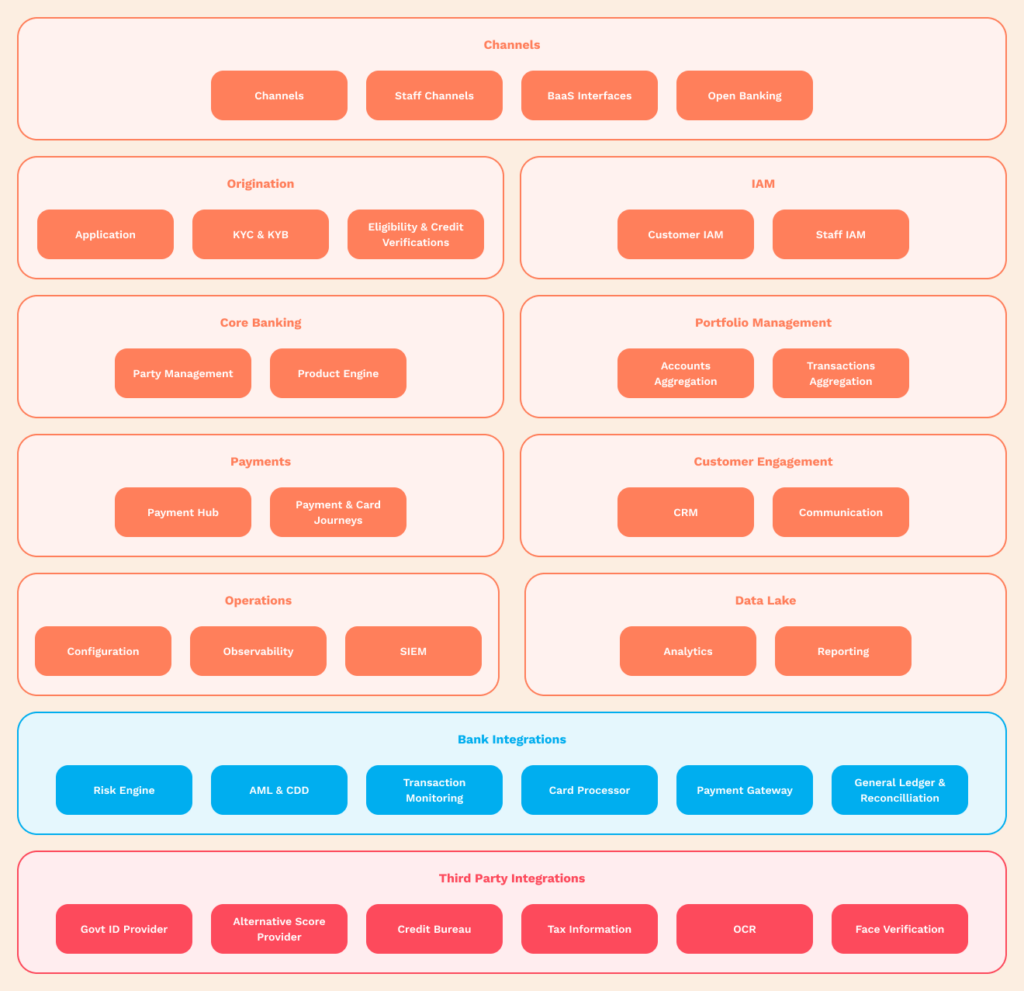

Domains

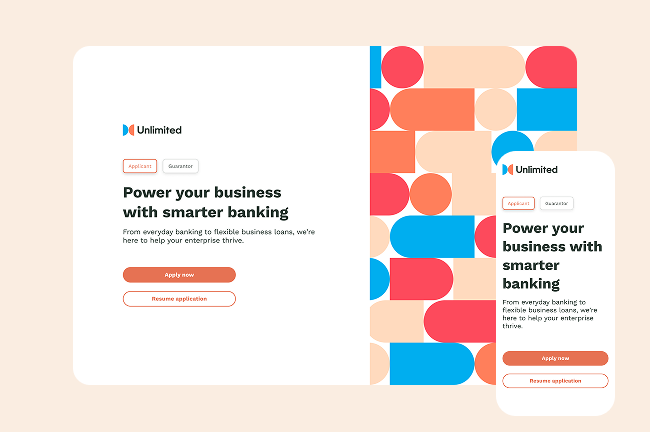

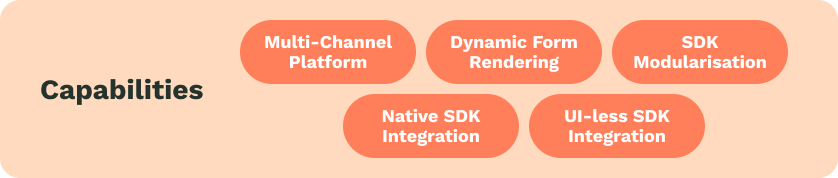

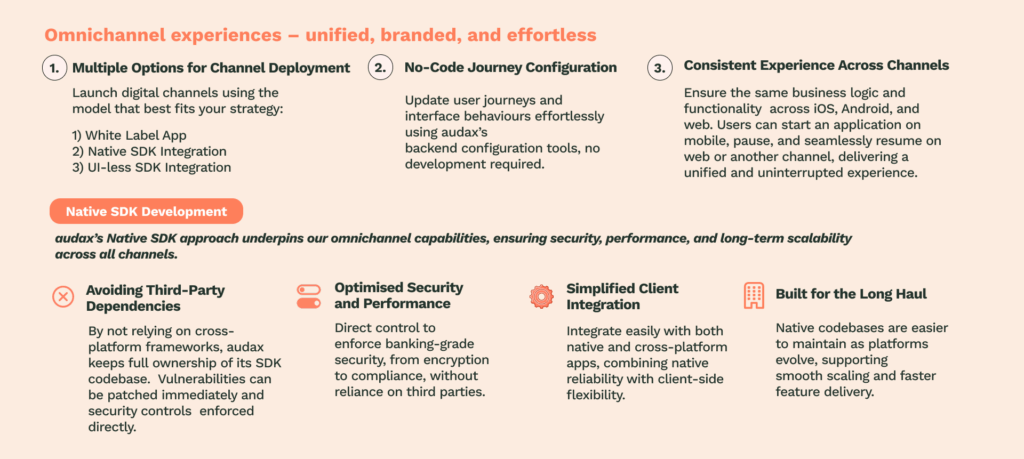

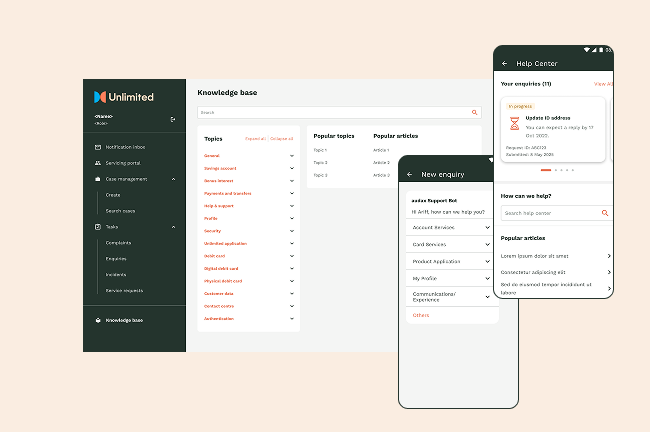

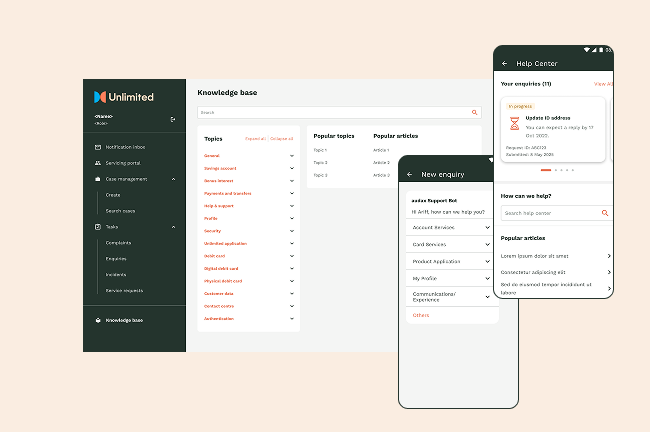

Channels

Deliver seamless, configurable digital banking journeys across iOS, Android, web, and partner platforms.

audax Channels enables banks to deliver high-quality digital experiences across mobile and web. Launch with a white-label app or build natively with audax SDKs, retaining full control over journeys, branding, and deployment.

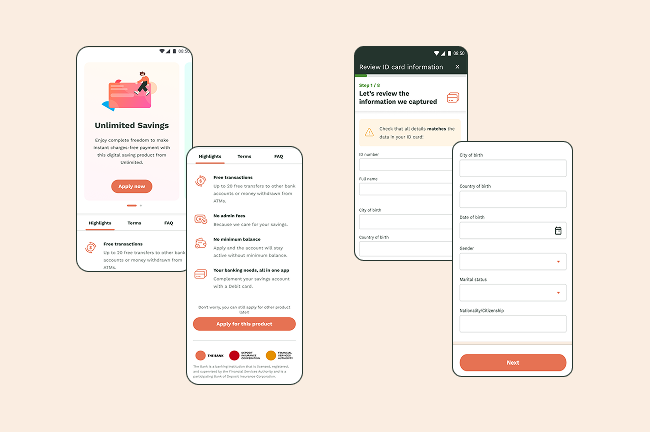

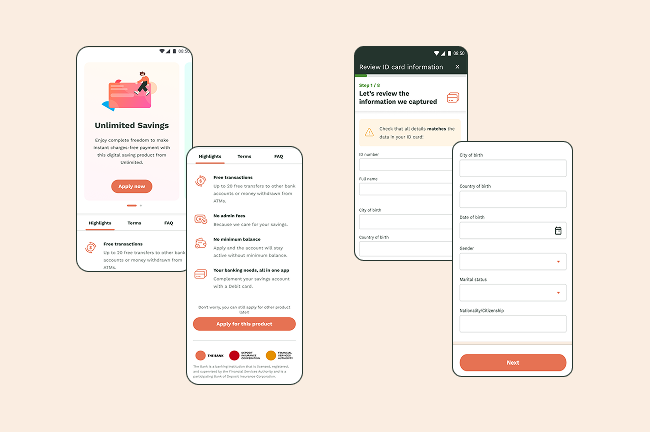

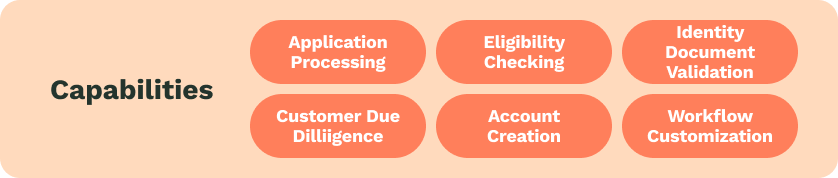

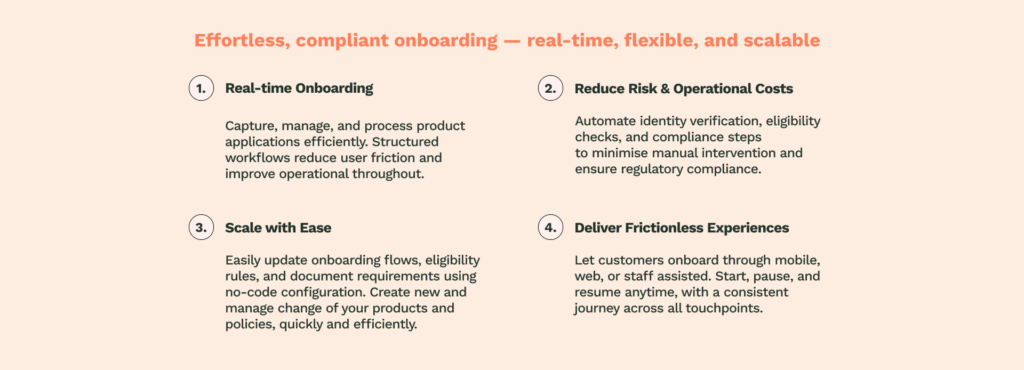

Origination

Onboard individuals and businesses with fast, compliant, and seamless digital journeys across any channel. audax Origination streamlines end-to-end onboarding for new and existing customers – automating applications, identity verification, eligibility checks, and account setup, ensuring secure, compliant, seamless experiences with speed, scale, and flexibility.

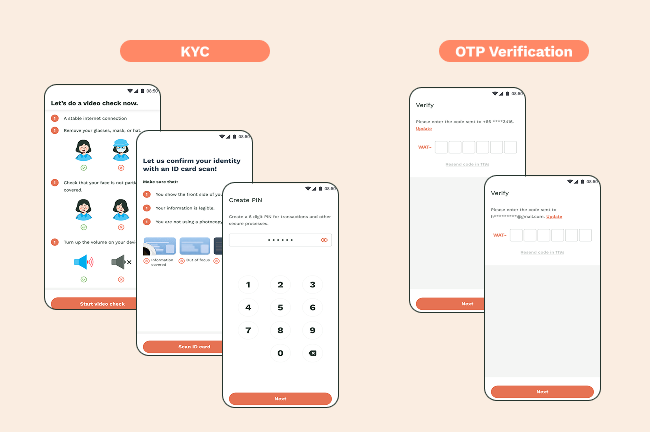

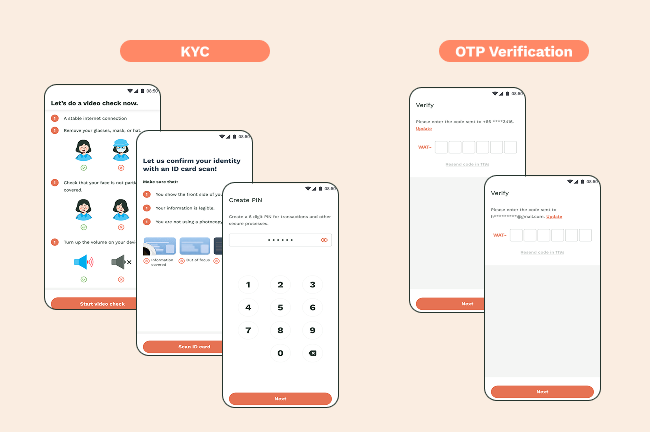

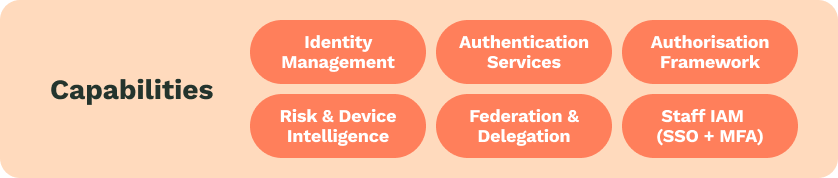

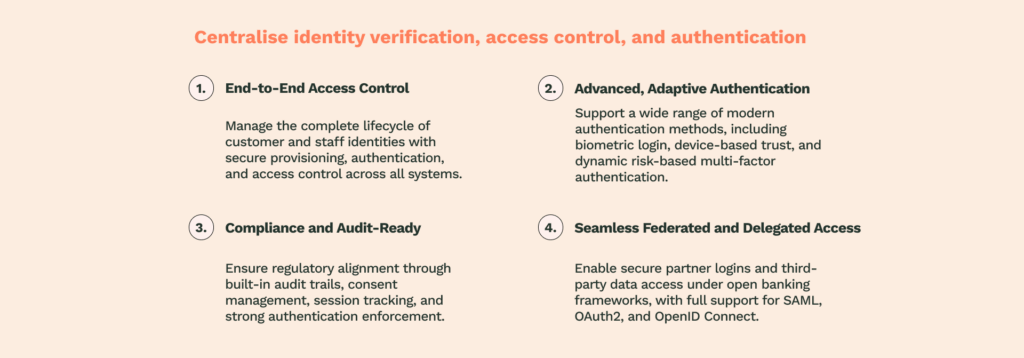

IAM

Protect customers, staff, and data with enterprise-grade security for financial services. audax IAM secures access for customers and internal users with modern authentication, fine-grained authorisation, and compliance support – protecting every touchpoint from MFA to federated login to delegated access.

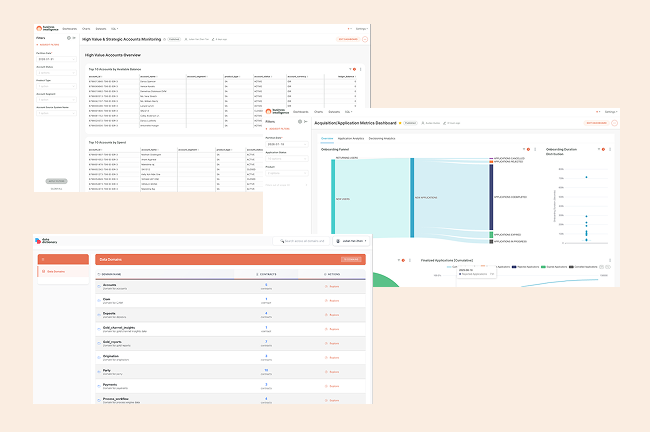

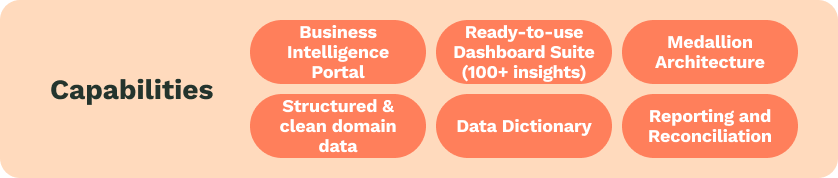

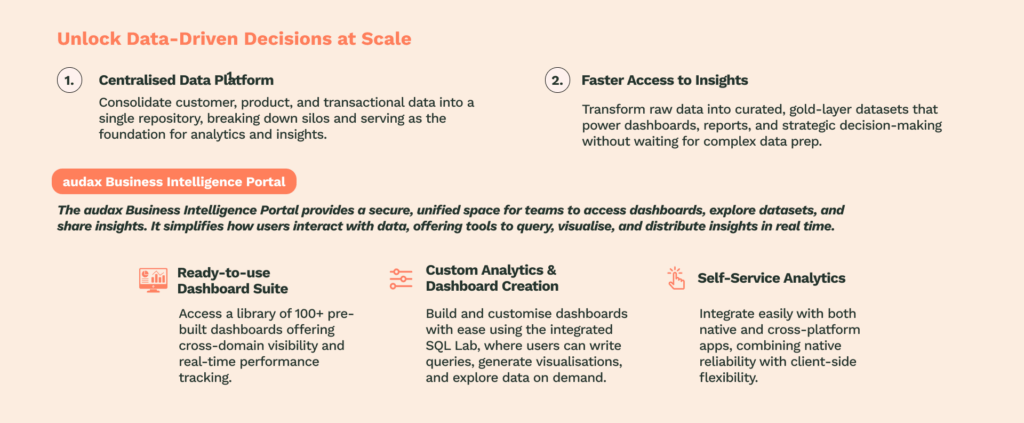

Data Lake

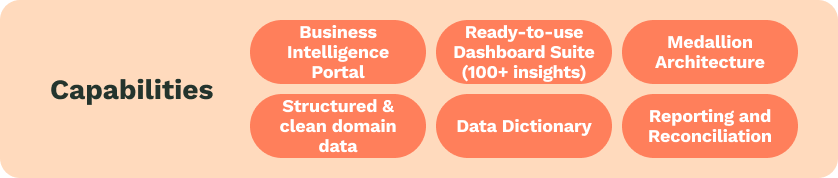

Consolidate, transform, and activate your data with a modern, secure, and scalable data lake architecture. audax Data Lake transforms operational data into structured, analytics-ready layers using a medallion architecture. With integrated dashboards and reporting tools, it enables business and functional teams to track customer activity, generate insights, and make faster, data-driven decisions.

IAM

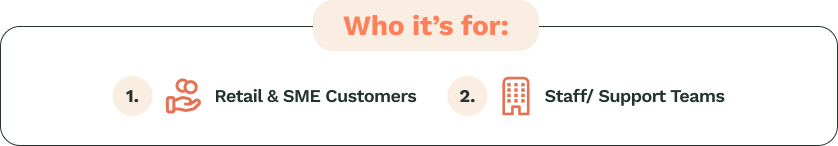

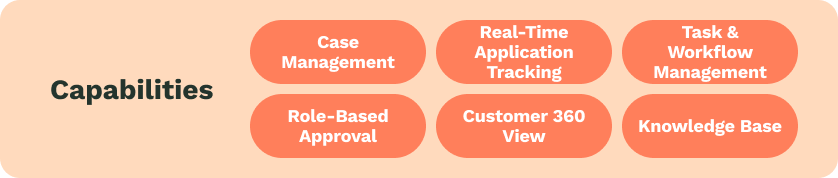

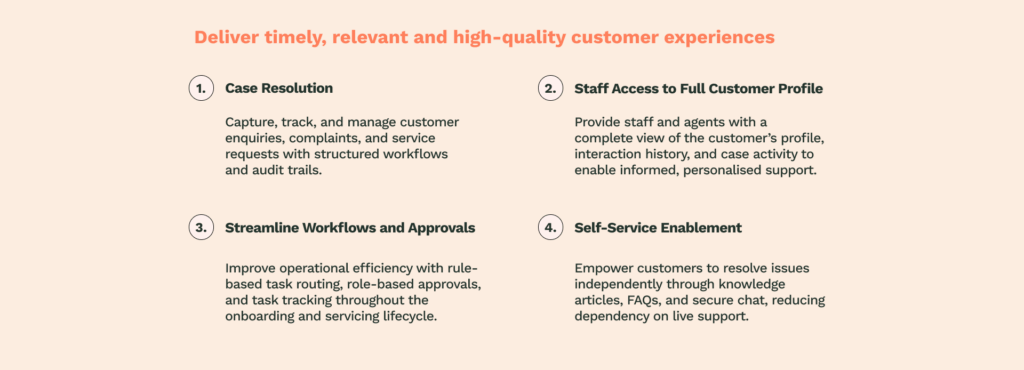

Personalised service and communication in one unified platform. audax Engagement drives customer connection through integrated channels including SMS, email, push notifications, and secure chat, combined with full servicing capabilities; CRM tools, knowledge articles, and structured case management.

Operations

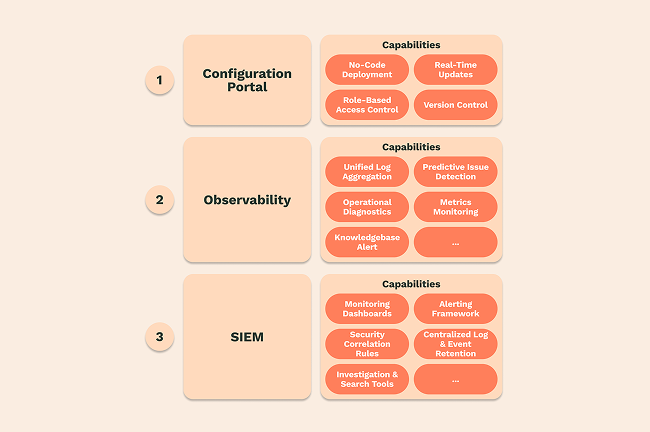

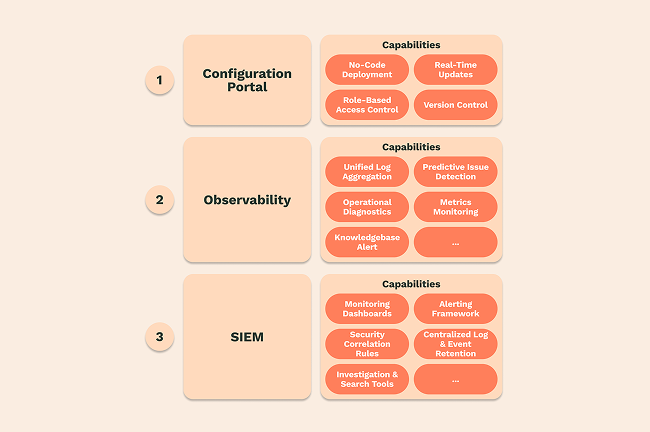

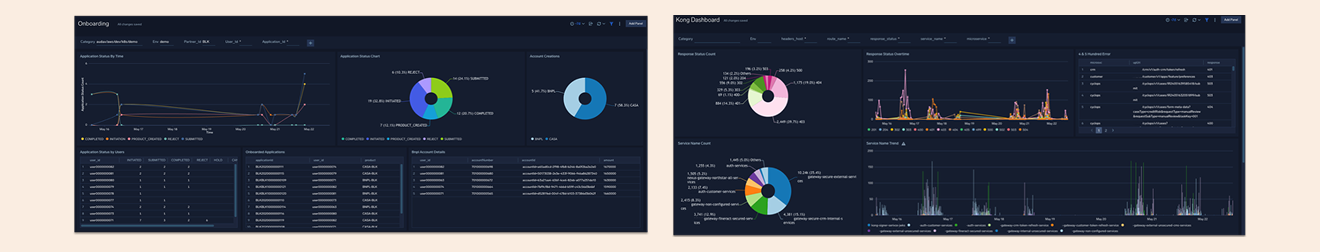

Centralised control and visibility across system configuration, platform health, and security monitoring. audax Operations unifies real-time observability, configuration management, and monitoring dashboards into a single module. It enables business and support teams to make backend changes without redeployment, monitor application and infrastructure health, and respond swiftly to security or operational events.

Product Engine

Create and manage financial Products with flexibility and Scale. audax Product Engine delivers core banking capabilities, covering deposits and unsecured lending, while integrating seamlessly with existing or external product systems. It supports rapid product launches, adapts to evolving business needs, and connects effortlessly across cloud or on-premise environments.

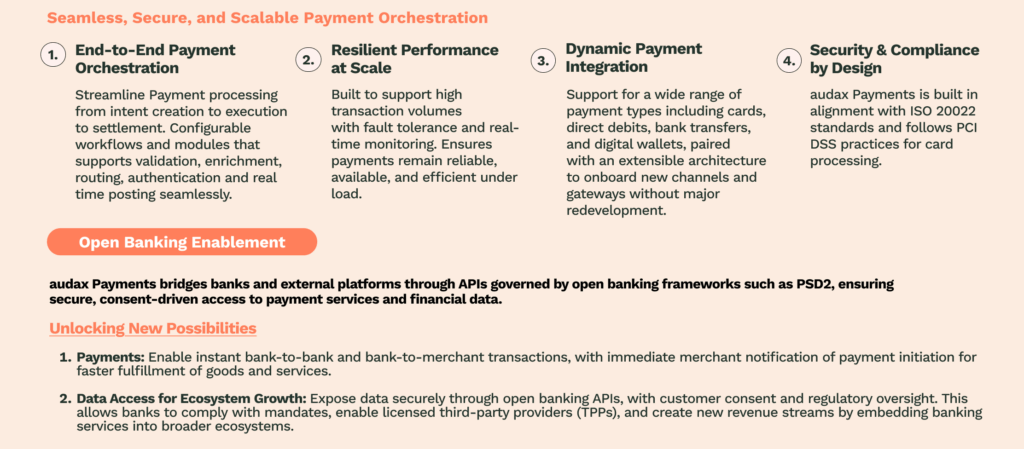

Payments

Unify, optimise, and secure your payment flows across channels, gateways, and partners. audax Payment Hub acts as a seamless, secure, and scalable payment orchestration platform, simplifying payment and transaction processing end-to-end. By integrating with your bank’s existing payment systems and card processors, it provides full lifecycle payment management, from initiation and processing to reconciliation and card issuance journeys.

Additional services

Platform Delivery & Implementation

- Platform delivery

- Partner and vendor integration services

- Localisation

- Software as a Service

Consulting & Advisory Services

- Business model setup and country landscaping

- Market regulations

- Risk management and design

- Partner acquisition strategy

Value-Added Services

- Program management

- Data products and user insights

- User experience and design

Frequently asked questions

We are a digital banking capabilities provider that empowers banks and financial institutions to scale and modernise at speed. Here are some of the challenges we can help to address.

- Developing alternative business models

- Speed to market

- Building for the future

- Dynamic product changes

- Upgrading legacy infrastructure with a need for core migration

- Legacy tech ownership costs

- Adaptability to change

- Maintain relevance

Our cloud-native digital banking platform is rapid deployable, enabling banks and financial institutions to pursue scaled digital businesses, including digital banking, Banking-as-a-Service (BaaS), embedded finance and more. Our platform can help banks to:

- Accelerate customer acquisition

- Lower risk/cost of new customers

- Access to larger volumes of data

- Create a contextualised value proposition

- Dramatically lower the cost of new services

- Enable digital eco-systems with financial services

Our approach and technology enable our customers to:

- Exponentially grow ecosystem with hundreds of partnerships securely using the bank’s core assets

- Serve bank customers like a full digital bank, keeping cost down; acquiring and serving all in-app

- Segregate partnership technology from BAU to mitigate scaling risks to core and better service delivery

- Test new use cases and business models quickly and with low risk

Our platform provides new technology rails, which will safely and securely enable the bank’s core assets to be utilised by new products, domains and partners. The assets include:

- Bank’s KYC/AML and credit decisioning rules

- Payment rails

- License/balance sheet

- Regulator reporting

- Bank’s infrastructure (on premise or cloud)

Embedded finance is an experience Embedded finance refers to the integration of financial services and products into non-financial platforms and businesses, such as e-commerce, social media, or transportation services. Companies can now offer a more seamless and convenient experience for their customers, reducing their friction to obtain financial products such as loans, insurance, investments, and more. Banking-as-a-Service is an enabler Banking-as-a-Service (BaaS) is a model that enables banks & financial institutions to securely distribute financial products to facilitate embedded finance customer experiences via API’s. Our BaaS technology rails enable banks to provide services such as eKYC, accounts, loans, credit cards and payments to these 3rd parties, managing the accounts, balance sheet, regulatory reporting and risk, whilst the digital partner manages the consumer acquisition.

Embedded Finance is the ability to streamline customer experiences by eliminating extra steps to obtain financing via a B2C digital service. BaaS is the ability for partners to securely distribute financial products to facilitate an embedded and white-labelled customer experience via API’s. BaaS allows banks to leverage on their retail banking license and balance sheet to achieve scale at a fraction of the price by creating new acquisition channels via multiple consumer platforms.

No. audax is a technology service provider that is installed and ran within the bank’s domain. The bank is the regulated entity per existing process. As such, audax will comply with all existing security and regulatory requirements of the bank as part of the checks to push to production.

Introducing our platform

Domains

Introducing our platform